When you’re on Medicaid and need a generic drug, you might assume it’s always covered - cheap, easy, and automatic. But that’s not true everywhere. In some states, you can walk into a pharmacy and get your generic blood pressure pill with no hassle. In others, you’re stuck waiting days for approval, paying up to $8 out of pocket, or even getting denied because your doctor didn’t fill out the right form. The truth? Medicaid generic coverage isn’t a national rule. It’s a patchwork of 51 different systems - one for each state and Washington, D.C.

What’s Covered? The Federal Floor and State Flexibility

All 50 states and D.C. cover outpatient prescription drugs under Medicaid. That’s not optional - it’s a de facto standard. But federal law only sets the minimum. The Affordable Care Act says states must cover any drug from manufacturers who’ve signed up for the Medicaid Drug Rebate Program. That covers almost every generic on the market. But there are exceptions: fertility drugs, weight-loss pills, erectile dysfunction meds, and cosmetic treatments are excluded nationwide. Beyond that, states are free to decide what else to include, how to prioritize drugs, and how to control costs. That’s where things get messy. One state might list 300 generic drugs as preferred. Another might only list 120. Some require you to try a cheaper version first. Others let your doctor pick whatever they think works best.Generic Substitution: Mandatory or Optional?

At least 41 states require pharmacists to substitute a generic drug when it’s available and therapeutically equivalent. That means if your doctor prescribes brand-name lisinopril, the pharmacist can legally swap it for the generic version - unless you or your doctor says no. But even here, rules vary. In Colorado, the law says the generic must be dispensed unless the brand is cheaper or you’ve been stable on the brand for a long time. In California, substitution is automatic unless flagged by the prescriber. Meanwhile, in 12 states, pharmacists can switch your drug without even telling your doctor. This isn’t just paperwork. It affects your health. A 2024 University of Pennsylvania study found that when Medicaid patients were forced to switch medications due to coverage rules, hospital admissions jumped by 12.7%. That’s not just inconvenient - it’s dangerous.Formularies: The Hidden List That Controls Your Access

Every state has a Preferred Drug List (PDL). Think of it like a menu of drugs Medicaid will pay for without extra steps. Tier 1 is usually generic drugs - the cheapest, most common ones. Tier 2 is brand names. Tier 3? Sometimes specialty generics, like those for diabetes or high blood pressure. But here’s the catch: just because a drug is on the list doesn’t mean you can get it easily. Some states require “step therapy.” That means you have to try and fail on two or three cheaper drugs before they’ll approve the one your doctor wants. In Colorado, for example, if you need a certain stomach medication, you must have tried all preferred NSAIDs and three different proton pump inhibitors first - all at maximum doses - within six months. Other states, like Massachusetts, have simpler lists. Fewer steps. Fewer denials. A 2024 Commonwealth Fund survey gave Massachusetts 4.6 out of 5 stars for formulary clarity. Mississippi? 2.8. That’s not a typo. It’s the difference between getting your medicine on time and getting stuck in bureaucratic limbo.

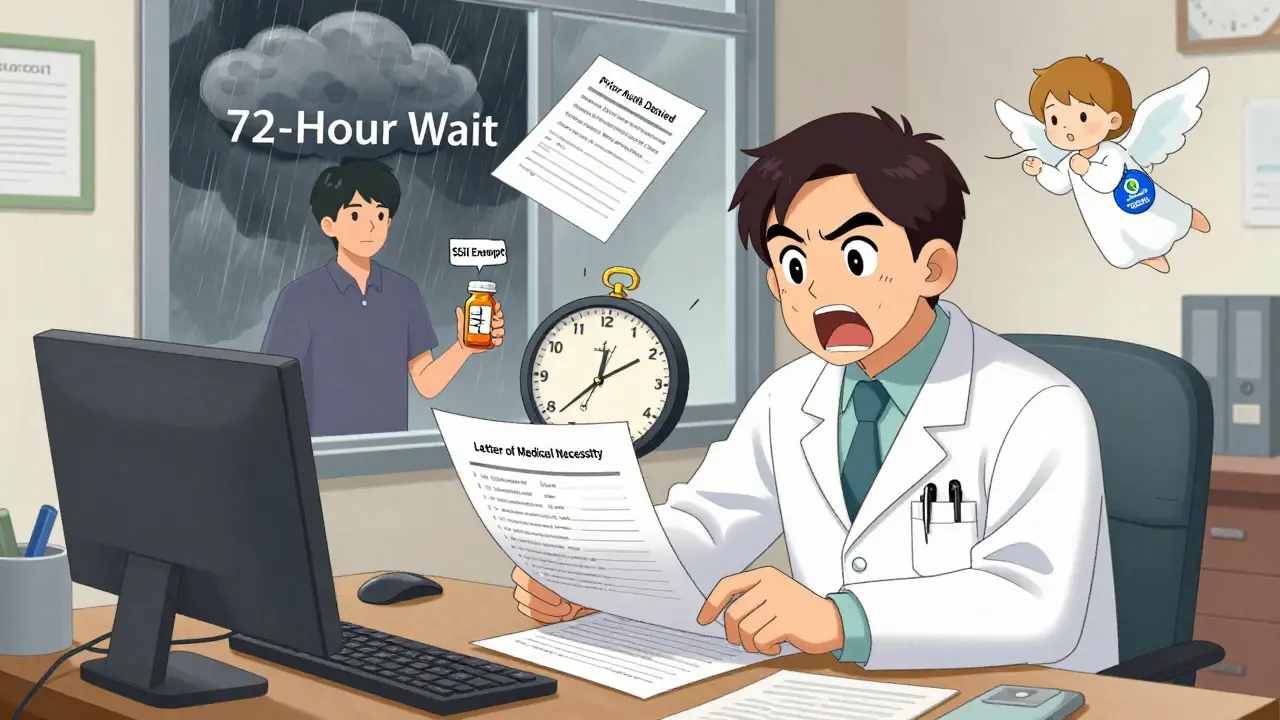

Prior Authorization: The Waiting Game

If your drug isn’t on the preferred list, you’re likely facing prior authorization. That’s when your doctor has to call, fax, or submit an online form explaining why you need this specific drug. The state then reviews it - and may approve, deny, or ask for more info. Approval times vary wildly. In Colorado, decisions come back in 24 hours. In some states, it takes up to 72 hours. For someone with chronic pain or high blood pressure, those extra days can mean worsening symptoms or emergency visits. Opioids are especially tight. Many states limit initial prescriptions to seven days and cap daily doses at eight pills. That’s not just about abuse prevention - it’s about cost control. But it also means people who rely on these meds for chronic conditions often get caught in the crossfire.Copays: Paying Out of Pocket - Or Not

Medicaid doesn’t always cover the full cost. States can charge copays - but only up to $8 for non-preferred generics if your income is below 150% of the federal poverty level. That’s $1,950 a year for an individual in 2025. But here’s the twist: many states don’t charge anything at all. In New York, there are no copays for generics. In Texas, you might pay $1 to $3. In Florida, it’s $4. And in some states, if you’re on Supplemental Security Income (SSI), you pay $0 - no matter what drug you get. The problem? Even small copays can be a barrier. A 2025 KFF report found that low-income patients skip refills when they can’t afford the copay - even if it’s just $3. That’s not laziness. It’s survival.Who’s Running the Show? Pharmacy Benefit Managers

Most states don’t manage their own pharmacy benefits. They outsource to big companies called Pharmacy Benefit Managers (PBMs). CVS Caremark, Express Scripts, and OptumRx handle Medicaid pharmacy programs in 37 states as of early 2025. That means your coverage depends on a corporate contract - not state law. These companies set formularies, negotiate rebates, and decide which drugs get approved. And they’re not always transparent. A doctor in Ohio might get a different formulary list than one in Georgia, even though both states use the same PBM. Worse, these PBMs often get paid based on how much they save. That creates pressure to push cheaper drugs - even if they’re not the best fit. A 2024 study from the American Medical Association found that primary care doctors spend an average of 15.3 minutes per patient just navigating prior authorizations. That’s over $8,200 a year in lost time per doctor.

What’s Changing in 2025 and Beyond?

Big changes are coming. In December 2024, CMS proposed a rule requiring all Medicaid programs to cover new anti-obesity drugs - a first for a specific drug class since the Affordable Care Act. If it passes, it could affect nearly 5 million people. But there’s a catch. Congress is also considering a bill that would remove inflation rebates for most generic drugs. Right now, drugmakers pay back a portion of price hikes to Medicaid. If that rule changes, states could lose up to $1.2 billion a year in rebates. That means tighter formularies, higher copays, or even fewer generics covered. Another shift? More states are testing value-based contracts for generics - paying based on outcomes, not just volume. Michigan’s pilot program for diabetes drugs cut costs by 11.2% while keeping patients on their meds. That’s the future. But only 9 states are doing it so far.What You Can Do If You’re Struggling to Get Your Medication

If you’re stuck:- Ask your pharmacist if they can switch to a preferred generic - even if your doctor didn’t prescribe it.

- Request a formulary exception from your state’s Medicaid office. You have the right to appeal.

- Check if your state has a patient assistance program for drugs that aren’t covered.

- Call your state Medicaid helpline. They’re required to explain your coverage.

- If you’re denied, ask your doctor to write a letter of medical necessity. Many approvals happen after that.

Final Reality Check

Medicaid was meant to make healthcare accessible. But when it comes to generic drugs, access isn’t guaranteed - it’s negotiated, restricted, and sometimes denied. The system works well for some. For others, it’s a maze of paperwork, delays, and hidden costs. The good news? You’re not powerless. Know your state’s rules. Ask questions. Fight denials. And remember: your health matters more than any form.Do all states cover generic drugs under Medicaid?

Yes. All 50 states and Washington, D.C., cover outpatient generic drugs under Medicaid. It’s not optional under federal law - every state provides this benefit to all eligible enrollees. But how they cover them - including copays, prior authorizations, and formulary rules - varies widely.

Can I be forced to switch from a brand-name drug to a generic?

In 41 states, yes - pharmacists can automatically substitute a generic if it’s therapeutically equivalent and approved by the state. But you can refuse. Your doctor can also write "Do Not Substitute" on the prescription. Some states, like Colorado, require substitution unless the brand is cheaper or you’re already stable on it.

Why does my state deny coverage for a generic drug I’ve taken for years?

Even if a drug is generic, it might not be on your state’s Preferred Drug List. States often remove drugs that become too expensive, even if they’re generics. Or they may require step therapy - meaning you must try cheaper alternatives first. Check your state’s formulary online or call Medicaid directly to find out why it was denied.

How much can I be charged for a generic drug under Medicaid?

States can charge up to $8 per prescription for non-preferred generics if your income is under 150% of the federal poverty level. Many states charge less - $1 to $4 - and some charge nothing at all. If you’re on SSI or have very low income, you may pay $0. Always ask your pharmacy or Medicaid office about your exact copay.

What if I need a generic drug that’s not on my state’s formulary?

You can request a formulary exception. Your doctor must submit a letter explaining why the drug is medically necessary - for example, if other generics caused side effects or didn’t work. Many denials are overturned after this step. Some states also have emergency override processes for urgent cases.

Can I use Medicare Extra Help with my Medicaid generic coverage?

Yes. If you qualify for both Medicaid and Medicare (dual eligible), you can get Extra Help to lower your Part D drug costs. Starting in 2025, you can change your Medicare drug plan once per month. This gives you more flexibility to find a plan that covers your generics without gaps - but you’ll need to coordinate carefully to avoid losing Medicaid coverage.

Why do some pharmacies refuse to fill my Medicaid generic prescription?

Some pharmacies, especially independent ones, don’t participate in Medicaid because reimbursement rates are too low. In Vermont, 98% of pharmacies accept Medicaid. In Texas, it’s only 67%. If your pharmacy won’t fill it, ask for a list of participating pharmacies from your state’s Medicaid office. You can also switch to a mail-order pharmacy - many states offer this for chronic medications.

Gregory Parschauer

This isn't healthcare - it's a corporate extortion racket disguised as public policy. PBMs are the real villains here, siphoning billions while patients suffer. They don't care if you live or die - they care about rebate margins. And don't get me started on the 'step therapy' torture porn. You're not a patient. You're a spreadsheet cell.

States are complicit. They outsource their moral responsibility to Wall Street middlemen who don't even have a license to practice medicine. This isn't a policy failure - it's a deliberate design to extract profit from desperation. Wake up, people. This is state-sanctioned medical abuse.

And yes, I've been denied my generic blood pressure med for 11 days because some PBM algorithm decided I 'should try a cheaper option.' I ended up in the ER. Guess who paid? Taxpayers. Again.

Stop calling this 'access.' It's rationing by bureaucracy.

Also, 'Do Not Substitute' on prescriptions? That's a joke. Pharmacists ignore it. They're paid to push generics. Period.

James Castner

One cannot adequately address the structural inequities embedded within the Medicaid generic drug coverage framework without first acknowledging the ontological dissonance between federal mandates and state-level administrative discretion. The Affordable Care Act, while establishing a de facto baseline, deliberately ceded interpretive sovereignty to individual jurisdictions - a move ostensibly rooted in federalist principles, yet functionally resulting in a labyrinthine patchwork of pharmaceutical access that disproportionately burdens low-income populations.

Pharmacy Benefit Managers, as private intermediaries wielding quasi-regulatory authority, have effectively privatized public health governance. Their incentive structures - predicated on cost avoidance rather than therapeutic efficacy - create perverse outcomes: patients are not treated, they are optimized. The 12.7% spike in hospital admissions due to forced generic substitution is not a statistical anomaly - it is the predictable consequence of commodifying clinical judgment.

Furthermore, the notion that a $8 copay is 'affordable' for those below 150% of the federal poverty line is a grotesque semantic evasion. For many, this represents 10% of their monthly food budget. To label such a barrier as 'minor' is to engage in moral abstraction that renders human suffering invisible.

The future lies not in incremental reform, but in systemic reorientation: value-based contracting must replace volume-based reimbursement. Michigan’s pilot program, while nascent, offers a paradigm shift - where outcomes, not volume, determine payment. This is not merely fiscal prudence - it is ethical necessity.

Until we treat pharmaceutical access as a human right - not a negotiated privilege - we will continue to witness the institutionalized suffering of the most vulnerable among us.

Lance Nickie

why do states even bother with all this mess? just cover the damn generics. its 2025. we have apps for everything. why cant my med get approved in 2 mins?

Milla Masliy

I’m from Texas and I’ve been on Medicaid for 8 years. The copay is $1 for generics - but I’ve had to fight for my diabetes med twice because it wasn’t on the PDL. My pharmacist helped me file the appeal - it took 3 weeks. I’m not mad, I’m just tired.

One thing I’ve learned: call your state’s Medicaid helpline. They’re not perfect, but they know the loopholes. My caseworker told me to ask for an 'emergency override' - that’s how I got my med.

Also, if you’re on SSI, you pay $0. Make sure they know that. Sometimes the pharmacy doesn’t either.

And yeah, PBMs are sketchy. But I’ve met pharmacists who go out of their way to help. Don’t give up on them.

Damario Brown

so the real issue is that pbms are private companies that make money by denying care. they’re not even regulated like insurers. and doctors are spending 15 mins per patient just filling out forms? that’s insane. why aren’t we suing them? why isn’t congress doing anything? this is literally life or death and everyone’s just shrugging.

also, i got denied my generic for anxiety because it wasn’t on the list. i had to pay $28 out of pocket. i’m a veteran. i served. now i can’t afford my meds. this isn’t america. this is a dystopia.

John Pope

Let me break this down for you, because clearly the system is too complex for your average citizen to navigate - and that’s the point. The entire Medicaid pharmacy infrastructure is a performance art piece designed to exhaust the vulnerable into submission.

Step therapy? That’s not medicine - it’s psychological warfare. You’re not being treated. You’re being trained to accept suffering as normal.

And don’t even get me started on the 'formulary exception' process. It’s a trapdoor. You submit your doctor’s letter. They sit on it for 72 hours. By then, you’ve missed two doses. Your blood pressure spikes. You go to the ER. Now the system gets paid. You get billed. Everyone wins - except you.

Meanwhile, the CEO of Express Scripts just bought a private island. Coincidence? I think not.

And yes, I’ve been denied my generic statin. I’m 52. I have a family. I’m not asking for luxury. I’m asking to not die because some algorithm decided I’m too expensive to keep alive.

Clay .Haeber

Oh wow. So Medicaid’s got a Netflix algorithm for your pills now? 'Hey, you liked lisinopril? Try this cheaper one that made your grandma hallucinate!'

And let’s not forget the real MVP here: the PBM exec who gets a bonus every time they deny a drug. I bet their Christmas bonus is bigger than my rent.

Meanwhile, my neighbor’s kid has to take 3 different generics before they’ll let him have the one that doesn’t make him vomit. That’s not healthcare. That’s a cruel game show. 'Will the patient survive the 5-day approval wait? Or will they end up in the ER? Tune in next week!'

And don’t even get me started on 'Do Not Substitute' - that’s like putting a 'Do Not Touch' sign on a nuclear reactor. Nobody reads it. They just hit 'approve' and move on.

Also, why does my state charge $4 for a pill that costs 7 cents to make? Is this a charity or a Ponzi scheme?

Priyanka Kumari

I’m from India and I’ve worked in public health here. What I see in the U.S. Medicaid system is both familiar and shocking. We have rationing too - but at least we don’t outsource it to profit-driven corporations.

Here, the problem isn’t just access - it’s dignity. People are being treated like numbers in a spreadsheet. I’ve seen mothers skip their meds so their kids can eat. That’s not policy. That’s tragedy.

But I’ve also seen communities organize. In Kerala, we used local health workers to help people appeal denials. It worked. Maybe U.S. communities can do the same?

Ask your pharmacist. Talk to your doctor. Write to your state rep. Don’t wait for someone else to fix it. Your life is worth fighting for.

Avneet Singh

Ugh. Another 'Medicaid crisis' thinkpiece. Newsflash: generics are cheap because they're generic. If you need a brand-name drug, pay for it. Stop expecting the state to fund your pharmaceutical preferences.

Also, 'step therapy'? That's called clinical judgment. Why should we pay for the latest $50 generic when the $2 one works fine? It's not discrimination - it's fiscal responsibility.

And PBMs? They save billions. You're welcome.

Stop crying about $8 copays. That's less than a coffee. Grow up.

Adam Vella

The fundamental flaw in the current Medicaid generic coverage paradigm lies in the misalignment between regulatory intent and operational implementation. While federal statutes establish a minimum standard of care, the delegation of formulary management to state agencies - and further to private PBMs - introduces systemic inefficiencies that violate the principle of equitable access.

It is not merely a matter of formularies or copayments; it is a failure of governance architecture. The absence of a unified national formulary, coupled with opaque PBM rebate structures, results in a fragmented delivery system that undermines the very purpose of Medicaid as a social safety net.

Furthermore, the empirical data demonstrating increased hospitalizations due to medication switches is not anecdotal - it is a direct consequence of policy fragmentation. This is not a technical issue. It is an ethical one.

Recommendation: Federal standardization of Preferred Drug Lists with mandatory transparency in PBM rebate disclosures. Anything less is institutional negligence.

Nelly Oruko

i just want my pills. why is this so hard? i had to wait 2 weeks for my blood pressure med. my bp went up. i almost passed out. i’m not asking for a luxury. i’m asking to not die.

also, the pharmacy i go to doesn’t take medicaid. i have to drive 20 miles. i don’t have a car. so i just… skip. i’m sorry. i’m tired.

vishnu priyanka

Been there. My uncle in Florida got denied his generic for heart failure because the PBM said 'try the other one first.' He tried three. None worked. He ended up in the hospital. Took 3 months to get approved.

But here’s the thing - he didn’t give up. He called the state helpline every day. He printed out the formulary. He had his doctor write a letter. And guess what? It worked.

Don’t let them tell you it’s hopeless. It’s broken - but not beyond repair. You’ve got rights. Use ‘em.

Alan Lin

To anyone struggling: you are not alone. I’ve worked with Medicaid patients for over a decade. I’ve seen the denials, the delays, the tears.

But I’ve also seen people win. Not because they were lucky - because they were relentless.

Step 1: Call your state Medicaid office. Ask for your formulary. Ask for the appeals process. Write it down.

Step 2: Ask your pharmacist to help you file a formulary exception. Most have templates.

Step 3: If denied, ask your doctor for a letter of medical necessity. Don’t let them say 'it’s too much work.' It’s your life.

Step 4: If still denied, escalate. Contact your state senator. File a complaint with CMS.

You are not a burden. You are a human being. And your health is not a privilege.

I believe in you. Keep going.

Milla Masliy

Alan Lin said it best - don’t give up. I just got my med approved after 4 weeks. My doctor’s letter did the trick. Also, I found out my state has a patient assistance program for non-covered generics. It’s not perfect, but it’s something.

And to the person who said 'just pay $8' - I wish I could. I work two jobs. I’m a single mom. $8 is lunch for my kid. I chose food over pills. That’s not a choice. That’s a system failure.

But I’m not giving up. Not today.