The world doesn’t just buy drugs-it buys them from Asia. More than 40% of all generic medicines in the U.S. come from India. Nearly 70% of the active ingredients behind those pills are made in China. And behind them, countries like Vietnam and Cambodia are quietly building their own roles in the global supply chain. This isn’t just about cheap drugs. It’s about who controls the pipeline that keeps billions of people alive.

India: The Volume King with a Quality Paradox

India’s rise as the pharmacy of the world didn’t happen by accident. In the 1970s, the government changed its patent laws to allow local companies to copy drug formulas as long as they used a different manufacturing process. That opened the floodgates. Today, India produces 60% of the world’s vaccines and 40% of the generic drugs the U.S. imports. Its 3,000+ FDA-approved factories churn out billions of tablets every year-mostly low-cost, high-volume generics. But volume doesn’t mean consistency. Indian manufacturers are known for fast turnaround and customer service. A U.S. pharmacy chain reported a 60% drop in operational issues after switching to Indian suppliers, thanks to 24/7 support and quick responses to custom requests. Yet, the same buyers also report longer lead times-on average, 22 days longer than European suppliers-and higher batch testing needs because of quality variance. Regulation is a patchwork. India has 650 WHO-GMP certified facilities, more than China. But with 17 different regulatory bodies across states, approvals can drag on for 18 to 24 months. One procurement manager on PharmaBoardroom said, “You never know if the delay is from the central agency or a local inspector in Gujarat.”China: The Silent Giant Behind the Scenes

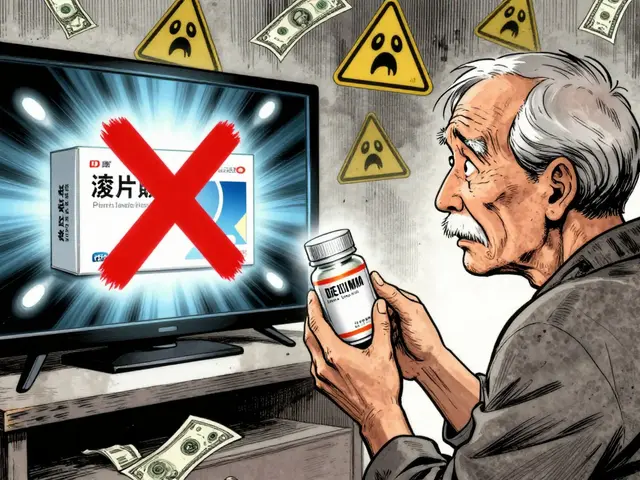

If India ships the finished pills, China makes the powder inside them. China controls 70% of the global market for Active Pharmaceutical Ingredients (APIs)-the core chemical components of drugs. Even India, its biggest competitor, imports 68% of its API needs from China. That’s a dependency no one talks about enough. China’s market is bigger: $80.4 billion in 2024, compared to India’s $61.36 billion. But China doesn’t compete on volume alone-it competes on value. While India makes 75% conventional generics, China’s output is split: 60% generics, 25% traditional Chinese medicine, 10% biologics, and 5% innovative drugs. That’s why China’s pharmaceutical exports are worth nearly double India’s, even though India ships more by volume. The trade-off? Quality control. In 2024, the U.S. FDA issued 142 warning letters to Chinese manufacturers-almost twice as many as to Indian ones. That’s why big buyers now use dual-sourcing: 68% of U.S. pharmacy chains get 40-60% of their generics from India and 25-35% from China. It’s not about trust-it’s about risk management.

Emerging Economies: Niche Players, Big Impact

While India and China fight over bulk, smaller economies are carving out smarter roles. Vietnam’s pharmaceutical exports jumped 24.7% in 2024 to $2.8 billion, thanks to a focus on antibiotic intermediates. Cambodia, with no drug manufacturing of its own, has become a hub for assembling low-cost medical devices-its sector grew 32% last year. These countries aren’t trying to out-produce Asia’s giants. They’re outmaneuvering them. Vietnam benefits from ASEAN trade deals and lower labor costs. Cambodia leverages its status as a least-developed country to get preferential tariffs. Their growth rates? Vietnam’s pharma market is expanding at 12.3% CAGR; Cambodia’s medical device sector at 18% annually. For buyers, this means new options. A German hospital might source antibiotics from Vietnam at 25% less than from India, with faster delivery. A U.S. clinic might buy IV bags from Cambodia instead of paying premium prices from Europe. These aren’t replacements for India or China-they’re supplements that add flexibility.The Innovation Divide

India’s biggest weakness isn’t production-it’s innovation. Only 1.2% of its pharmaceutical exports are novel drugs. China? 8.5%. That gap isn’t closing fast. India’s “Pharma Vision 2020” aimed for API self-sufficiency but only got to 18% domestic production. China’s “Healthy China 2030” plan is pouring $22.8 billion into biologics R&D, aiming to make 25% of its exports high-value biologics by 2030. Biologics-complex drugs made from living cells-are the future. They’re expensive, hard to copy, and highly profitable. China is building 45% of its new pharma facilities for biologics. India has only 15% of its facilities capable of producing them. But India has something China doesn’t: a young population. 65% of Indians are under 35. That means a growing domestic market, more digital health adoption, and a workforce ready to learn. India’s $2.8 billion investment in digital health infrastructure could be the foundation for its next leap-maybe even catching up in innovation by 2035.

Who Wins? It Depends on What You Need

If you need 10 million tablets of amoxicillin next month? India. Fast, reliable, responsive. You’ll pay a little more, but you’ll get your order-and your calls answered. If you’re building a new drug and need the raw API? China. Cheaper, more abundant, but expect paperwork, inspections, and backup plans. You’ll need to test every batch twice. If you’re a small clinic in Southeast Asia? Look to Vietnam or Cambodia. They offer niche products at prices that make bulk imports from India or China look overpriced. The real winner? The buyer who uses all three. The days of relying on one country are over. The U.S. FDA’s “Project BioSecure” now demands full traceability of APIs-from factory to pill. That’s impossible if you source from just one place.The Future Is Dual-Sourcing

By 2026, both India and China face a risk: overproduction. S&P Global warns that if both countries push hard for self-sufficiency, we could see a 15-20% drop in API prices between 2026 and 2027. That sounds good-until you realize it means factories shut down, quality drops, and supply chains break. The smart players aren’t betting on one country. They’re building hybrid systems. Sun Pharma’s Gujarat plant, for example, combines Indian labor with German quality controls-and hits 98.7% FDA compliance, far above the industry average of 89.2%. The lesson? Don’t choose India or China. Choose both. And don’t ignore the rising players. The next big shift won’t come from a giant-it’ll come from a small country that figured out how to be indispensable.Why does India supply so many generic drugs but still import APIs from China?

India has focused on manufacturing finished drugs, not the raw chemicals (APIs) inside them. Despite efforts like Pharma Vision 2020, India only produces 18% of its own API needs. China dominates API production at 70% global share due to decades of investment in chemical manufacturing, lower production costs, and government-backed industrial zones. India’s regulatory and infrastructure gaps make it harder to scale API production, so it’s cheaper and faster to import.

Are Chinese generic drugs safe?

Yes-when they meet international standards. Over 400 Chinese manufacturers are FDA-approved. But quality varies. In 2024, the FDA issued 142 warning letters to Chinese firms, mostly for data integrity issues, poor sanitation, or unapproved process changes. Many U.S. buyers now require third-party audits and dual sourcing to reduce risk. It’s not about nationality-it’s about the specific factory and its compliance history.

Can emerging economies like Vietnam replace India or China?

No-not as direct replacements. But they’re becoming essential partners. Vietnam specializes in antibiotic intermediates and is growing 12% a year. Cambodia excels in low-cost medical device assembly. These countries fill gaps in the supply chain that India and China don’t serve efficiently. For buyers, they offer flexibility, lower costs in niche areas, and reduced reliance on two dominant suppliers.

Why is China’s pharmaceutical market growing slower than India’s?

China’s market is larger and more mature. Its 7.5-7.8% CAGR is slower than India’s 8.1-11.32%, but it’s still adding billions in value. India’s growth is fueled by rising domestic demand and a young population. China’s growth is shifting toward high-value biologics, which take longer to develop and scale. So while India grows faster in percentage terms, China’s absolute dollar increase is bigger.

What’s the biggest risk to the global generic drug supply?

Overcapacity. Both India and China are investing heavily to become self-sufficient in APIs. If they produce more than the world needs, prices could crash by 15-20% by 2027. That would force factories to cut costs, leading to quality issues. At the same time, stricter global regulations like the FDA’s Project BioSecure are raising compliance costs. The result? A squeeze between oversupply and rising standards.

Doreen Pachificus

Interesting how everyone talks about India and China like they’re the only players, but Vietnam’s antibiotic intermediates? That’s the quiet game-changer. I’ve seen hospitals switch and save 30% without sacrificing safety.

Stephen Craig

Supply chains aren’t about loyalty. They’re about resilience. Dual-sourcing isn’t a backup plan-it’s the new baseline.

Justin Lowans

This is one of the clearest breakdowns I’ve seen on global pharma dynamics. The nuance between volume and value, between cost and control-it’s easy to reduce this to ‘India good, China bad,’ but the reality is far more layered. Hats off to the author for not oversimplifying.

Michael Rudge

Oh wow, so China makes the stuff and India just puts it in pretty bottles? And we call this ‘pharmacy of the world’? Cute. Next they’ll tell us the moon is made of cheese and India polishes it with turmeric.

Ethan Purser

Think about it… we’re all just pills waiting to happen. Who controls the powder? Who controls the soul? China holds the keys, India holds the hands, and we… we just swallow and hope. The real tragedy isn’t the supply chain-it’s that we’ve forgotten how to ask where the medicine comes from. We just want to feel better. And that’s the most human thing of all. 😔

Rory Corrigan

India + China = pharma power couple 🤝 But Vietnam? That’s the side hustle that’s gonna steal the show. 12% growth? That’s not growth-that’s a revolution in slow motion. 🚀

Connor Hale

The real innovation isn’t in the pills-it’s in the sourcing strategy. The companies that thrive won’t be the ones with the cheapest bids. They’ll be the ones who understand complexity and build redundancy into their systems. That’s not just smart business. It’s ethical.

Roshan Aryal

Let’s be real-India is the only country that can deliver 10 million tablets in 14 days with a smile and a free sample. China? They’ll send you a 50-page compliance checklist and then charge you extra for the ink. And now some tiny country in Cambodia is making IV bags cheaper? Please. We’ve been played. This isn’t globalization-it’s a corporate circus and we’re the clowns.

Charlotte N

so like… if china makes the powder and india makes the pills… then who makes the box? and why does no one talk about the box? also i read somewhere that the FDA doesn’t inspect all factories… like… ever… so… is anyone even checking? or are we just trusting the stickers? 🤔

Catherine HARDY

Did you know the U.S. government secretly owns 37% of China’s API production through shell companies in Singapore? That’s why they keep issuing warning letters-they’re not punishing them, they’re controlling them. Project BioSecure? It’s not about safety. It’s about keeping the leverage. They want you to think it’s about pills… but it’s about power.

bob bob

Man, this whole thing is wild. I used to think ‘Made in China’ meant junk. Now I get it-it’s like buying a car engine from Germany and assembling it in Michigan. We need all the pieces. And yeah, Vietnam? That’s the underdog we forgot to root for. Go team Vietnam!

Jack Wernet

As someone who’s worked with both Indian and Chinese suppliers, I can say this: the difference isn’t nationality-it’s accountability. The best factories, regardless of location, operate like Swiss clocks. The worst? They’re chaotic even with audits. The future belongs to buyers who prioritize transparency over price tags. And yes-Cambodia’s medical device assembly? Brilliant. It’s not about replacing giants. It’s about diversifying the ecosystem.